Assessing the impact of money laundering and terrorism financing on your business: a guide

Money laundering and terrorism financing (ML/TF) have far-reaching consequences, posing significant risks to economies, businesses, and societies worldwide. Financial institutions, gaming organisations and other regulated industry sectors may experience various detrimental effects, including harmful media exposure, reputational damage, regulatory fines, and customer doubts regarding regulatory effectiveness, if their organisations are used by organised criminal networks to launder the proceeds of their crimes.

It’s crucial to understand the potential impact of money laundering and terrorism financing on your business. Whilst Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations are designed to combat money laundering and terrorist financing, they can also help organisations better understand their customers and strengthen their defences against abuse by organised criminal networks. Businesses need to ensure they are compliant with these laws, whilst minimising the disruption on their operations, which can be particularly challenging for companies operating in many countries, with multiple lines of business, multiple products and services and delivered through multiple channels.

This guide will provide essential insights and strategies to assess and mitigate these risks. By proactively aligning your business practices with robust AML/CTF frameworks, you can safeguard your business’s reputation, protect against financial losses, and meet regulatory obligations.

Money laundering vs terrorism financing

Money laundering involves hiding the illegal origin and ownership of money obtained through criminal activities, making it seem legitimate. It supports and enables various criminal actions globally, including corruption, trafficking, fraud, etc.

Terrorism financing involves using funds to finance terrorist activities. However, it’s harder to detect because it often comes from legitimate sources. Tracking such funding can be challenging, as the amounts involved typically fall below reporting thresholds.

By curbing the financial flows associated with money laundering and terrorism financing, we can effectively address the issues of criminal and terrorist activities worldwide.

Facts: global money laundering

- Globally, criminals launder between $800 million and $2 trillion each year.

- In 2020 global banks were fined $10.4 billion in money-laundering violations.

- Fines are increasing year-on-year as organisations struggle to achieve compliance.

- Money laundering schemes cost between 2%-5% of the world’s total GDP.

- Despite over 90% of money laundering offenders being imprisoned, 90% of money laundering crimes still go undetected and only 1% of criminal proceeds are ever recovered

Source: Zippia.com

How to assess the impact of AML/CTF on your business

1. Understand the ML/TF risks

To effectively combat money laundering and terrorism financing, it’s crucial to educate yourself about the specific risks in your region or industry.

Laws and regulations constantly evolve, particularly as criminals use enhanced technology and employ more sophisticated techniques. Therefore, businesses should familiarise themselves with the latest rules and laws by region or industry to ensure they remain compliant and follow required protocols and reporting timeframes.

Compliance teams should also research typologies and red flags associated with illicit activities to monitor risks and develop effective mitigation strategies.

Anthony Quinn, founder and CEO of Arctic Intelligence,, emphasises the importance of identifying and addressing money laundering risks within your business. “Failing to do so can not only damage your reputation but lead to regulatory sanctions, all of which can harm your long-term reputation and bottom-line”, he warns.

2. Conduct an enterprise-wide ML/TF risk assessment

An enterprise-wide ML/TF risk assessment helps identify areas in your business with a risk of money laundering and terrorism financing. It evaluates your business operations, jurisdiction, product/service features, and customer base to pinpoint the most vulnerable areas.

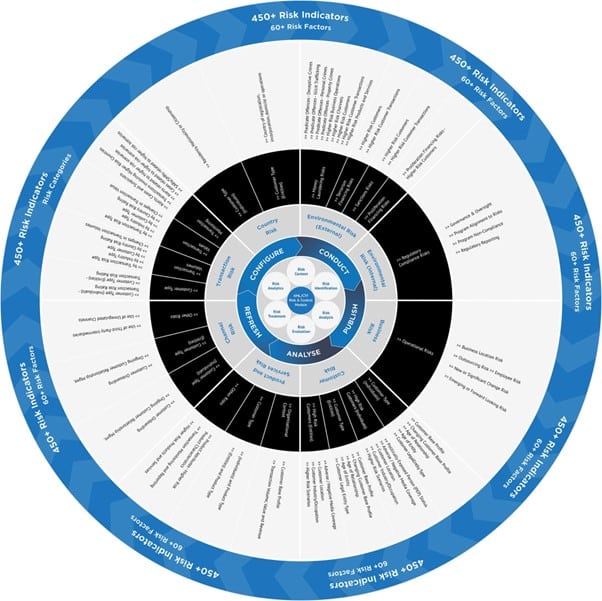

When developing an ML/TF risk assessment framework you need to assess risks across a number of different risk groups and risk factors including:

- Environmental Risks

- Business Risks

- Customer Risk

- Product and Services Risk

- Channel Risk

- Transaction Risk

- Geographic Risk

At Arctic Intelligence we have developed comprehensive risk and control modules based on these main risk groups, depicted in the diagram below:

At Arctic Intelligence, we have two financial crime risk assessment platforms. The first is our cloud-based AML Accelerate Platform to guide smaller and medium-sized businesses through a comprehensive ML/TF risk assessment process, helping them document their AML/CTF Program and to keep track of action plans easily. The second is our cloud-based, fully configurable Risk Assessment Platform for larger more complex businesses to help identify, assess, mitigate and manage AML/CTF, money laundering and terrorism financing, anti-bribery and corruption, sanctions, fraud, modern slavery, human trafficking, correspondent banking and wildlife trafficking.

Enterprise-wide financial crime risk assessments are not a static, tick-box exercise but are constantly changing based on different internal and external triggers, which are outlined below.

The table below summarises some of the event-based triggers:

| Regulatory external events | Other external events | Internal events |

| Enforcement activity targeted at certain sectors or activities – could these risks occur in your business? | Changes in the geo-political landscape making a country at higher risk than before. | External (or internal) independent review highlighting deficiencies in the ML/TF risk assessment. |

| Changes in AML/CTF regulations or rules – how do they impact your organisation? | Changes in various published country risk rankings (i.e., transparency international). | Review of ML/TF risk assessment prior to annual compliance reports being filed with the regulator. |

| Changes in guidance and risk typologies – has your ML/TF risk assessment considered this? | Increased media scrutiny on certain companies, industries or activities. | Organisation is launching or has launched new products services, which pose new ML/TF risks. |

| Consultation papers about proposed regulatory changes – what would be the impact on your business if these laws are enacted? | Changes in the threat landscape as criminals find more innovative ways to launder criminal proceeds. | Organisation is targeting new customer segments, expanding into new geographic markets or generally changing its business. |

| International guidance issued by the FATF, the Wolfsberg Group, the Egmont Group highlighting trends and risk-related guidance. | Emerging technologies that could pose new threats to your organisation, such as criminal use of Artificial Intelligence. | Merger and acquisitions activity (i.e., divestments, acquisitions) bringing together businesses with different risks and approaches. |

| Publishing of National RIsk Assessments highlighting threats at national, industry, product or activity level. | Collaboration through public and private partnerships could present opportunities to update ML/TF risks and controls. | Change in Board and/or Senior Management, with a greater focus on risk appetite and management. |

| Release of federal, state or local crime statistics that are relevant to your industry and operations. | Investigations by journalists or law enforcement into organised criminal activity that is related to your organisation’s operations. | Appointment of a new AML/CTF Compliance Officer/MLRO looking to make changes to the ML/TF risk assessment and AML Program. |

| Criminal or civil prosecutions or other enforcement action (i.e. enforceable undertaking, regulator appointed independent auditors). | Class actions being filed against organisations for failing to manage or disclose risks. | Appointment of risk, compliance or legal advisors with experience in conducting and updating ML/TF risk assessments. |

A robust financial crime risk assessment is crucial for effective compliance. It enables you to understand your financial crime risks and vulnerabilities, implement appropriate and proportionate systems, policies, procedures and controls to mitigate and manage these risks and address any gaps that you identify.

3. Know your customer (KYC)

In response to increased regulations and enforcement action, institutions face increased complexities in identifying and verifying customer identification, screening against watchlists, verifying sources of funds/wealth, assessing customer risk profiles on an ongoing basis and monitoring changes in transaction behaviours.

When starting a new financial relationship, regulated entities are required to collect proscribed identification documents to verify the customer’s identity and any relevant directors, officers and ultimate beneficial owners connected with corporate entities. It is important where possible to ensure the documents are genuine by validating their authenticity..

It is important to be able to identify red flags you may encounter when onboarding customers, including:

- new business customers who are reluctant to provide KYC information

- new customers with incomplete or conflicting information

- customers without phone numbers or using serviced offices or PO boxes

- customers whose activity is not typical (i.e., students with large cash balances)

Verification from original documents instead of photocopies or certified copies is more reliable, as is, verification from one or more electronic sources. Automation delivers efficient outcomes for KYC compliance by enhancing accuracy, verifying documents, and detecting counterfeits more effectively.

4. Enhanced customer due diligence

If you’ve identified higher-risk customers or transactions in your risk assessment, it’s crucial to apply enhanced customer due diligence (ECDD) measures as part of a risk-based approach.

According to the Financial Action Task Force (FATF), which is the international watchdog responsible for promoting adoption and adherence to money laundering, terrorism financing and proliferation financing laws recommend that enhanced customer due diligence measures should be implemented for business relationships and transactions involving natural and legal persons and financial institutions from countries designated as higher risk by the FATF.

Other situations that may require enhanced customer due diligence include:

- unusual business relationships, such as significant geographic distance between the business and the customer without a clear explanation

- non-resident customers or those who are under economic sanctions

- companies with nominee shareholders or shares in bearer form

- unusual or excessively complex beneficial ownership structures of companies, or lack of transparency

- countries with inadequate AML and CFT systems

- countries involved in funding or supporting terrorism or hosting terrorist organisations

- private banking activities

- anonymous or non-face-to-face transactions or business relationships

- receipt of payments from unknown or unrelated third parties

Enhanced customer due diligence involves research and close monitoring of the customer relationship. This may include gathering additional information, conducting background checks, and monitoring ongoing activities for consistency.

5. Implement internal controls

Establishing internal controls and procedures is crucial in reducing the risk of money laundering and terrorism financing. These measures allow businesses, especially those in the financial services and gaming sectors, to verify financial transactions and monitor suspicious activities.

Key actions to consider include:

Reviewing internal processes: Ensure all internal protocols align with AML/CTF guidelines and reflect the current regulatory framework specific to your industry or region. A comprehensive AML/CTF program should designate a senior individual responsible for addressing money laundering issues and empower them at the Board level and allow for them to engage with law enforcement or regulatory authorities when necessary.

Employee training programs: Implement training programs at all levels, including the board level, to ensure all employees and executives understand and comply with AML/CTF regulations. This training should cover reporting protocols, effective information management, and non-compliance consequences. In addition, employees in roles identified as posing a higher ML/TF risk should receive specialised training to understand their obligations and the specific risks faced by the business and themselves as individuals.

Transaction monitoring systems: Introduce robust monitoring systems and mechanisms for reporting suspicious activities. These systems can help identify and prevent illicit transactions by flagging unusual or suspicious patterns.

Regular audits: Establish a separate audit function or fraud department responsible for regularly testing the effectiveness of monitoring systems and ensuring compliance with regulatory standards.

6. Collaborate with authorities

As regulators continue to implement stricter measures to combat money laundering and terrorism financing it is imperative for regulated entities to make a concerted effort to eliminate illicit activities and engage proactively and positively with regulatory agencies.

Building cooperative relationships with law enforcement agencies, financial intelligence units, and regulatory bodies is vital as these relationships enable you to stay updated on emerging trends and regulations in the fight against money laundering and terrorism financing. By staying informed, you can align your prevention measures accordingly.

7. Monitor and report suspicious activities

As a regulated business, you must implement processes that continuously monitor customer transactions and account activities. Even after conducting initial Know Your Customer (KYC) checks, you must remain vigilant and identify any suspicious patterns or indicators of potential risk. Look out for the following red flags:

- Secretive new clients who avoid personal contact and refuse to answer questions about themselves as part of Know Your Customer (KYC) checks

- Unusual transactions that deviate from expected behaviour, such as large cash payments, unexplained third-party payments, or the use of multiple or foreign accounts.

- Transactions involving significant amounts of cash, private funding, or complex crypto assets.

- Transactions with unusual features, sizes, frequencies, or urgent instructions that don’t align with the customer’s profile.

- Complex ownership structures or the use of shell companies that may be an attempt to disguise criminal activities and carry out financial crime.

- Transactions potentially involving individuals or entities listed on international sanctions lists.

- Negative media coverage about the customer worldwide, which could increase AML risk and requires additional checks.

It’s essential to have a transparent process to report any suspicious activities to the appropriate authorities. You must also ensure that you meet the reporting obligations within your regulatory body’s specific timelines.

For instance, in Australia, if you suspect terrorism financing, you must submit suspicious matter reports (SMRs) to AUSTRAC within 24 hours, and for money laundering suspicions, within three business days. It’s important to note that reporting requirements may vary slightly depending on your region and regulatory body, so check with your relevant authority to ensure compliance.

8. Stay updated and adapt

Technology advancements are making it challenging for businesses to keep up with evolving money laundering and terrorism financing techniques but there has been significant advancements in anti-financial crime regulatory technology, such as those solutions offered by Arctic Intelligence.

To stay informed about changes in laws, regulations, and industry best practices is crucial to ensure ongoing compliance. Anthony Quinn, Arctic Intelligence’s CEO, suggests researching applicable laws and regulations and having your compliance team monitor updates from regulators. “There are valuable information resources available; the key is to know where to find them and access the most up-to-date information relevant to your industry or region,” he says.

Adapting processes to address emerging threats is crucial now and in the future. Accordingly, the FATF emphasises the importance of using big data and emerging technologies for financial crime investigations, which can help enhance AML/CFT effectiveness, speed, and cost reduction by adopting new technologies.

Closing thoughts

By following these steps, you can assess the potential impact of money laundering and terrorist financing on your business and implement effective risk mitigation measures.

Arctic Intelligence is widely recognised as an expert in financial crime regulatory technology. If you’re interested in finding out more, book a demo of our award-winning risk assessment platforms to see the benefits for your business.

You can also try our new savings calculator, which estimates the time and effort you spend annually on designing, implementing, and maintaining business-wide risk assessments. It then shows you the potential cost and time savings you can achieve using our platforms.

Using the right technology system can allow you to identify potential criminals involved in money laundering and ensure compliance with laws, international treaties, and regulations to protect your business.

If you’d like to see how our platforms can help simplify your compliance obligations, book your demo today.

Follow us on LinkedIn and Twitter for a daily dose of financial crime news across the globe.